Helen Keller Services is committed to helping people of all ages gain the skills they need to live their best lives.

We’ve built programs like our Children’s Learning Center (CLC), which provides early adaptive education for infants and toddlers.

Home-based early intervention services, inlcuding occupational, speech and physical therapies offered to infants and toddlers, up to age 3.

Full-day preschool, including group learning and one-on-one therapies for young children with sensory loss and/or multiple disabilities, ages 3-5.

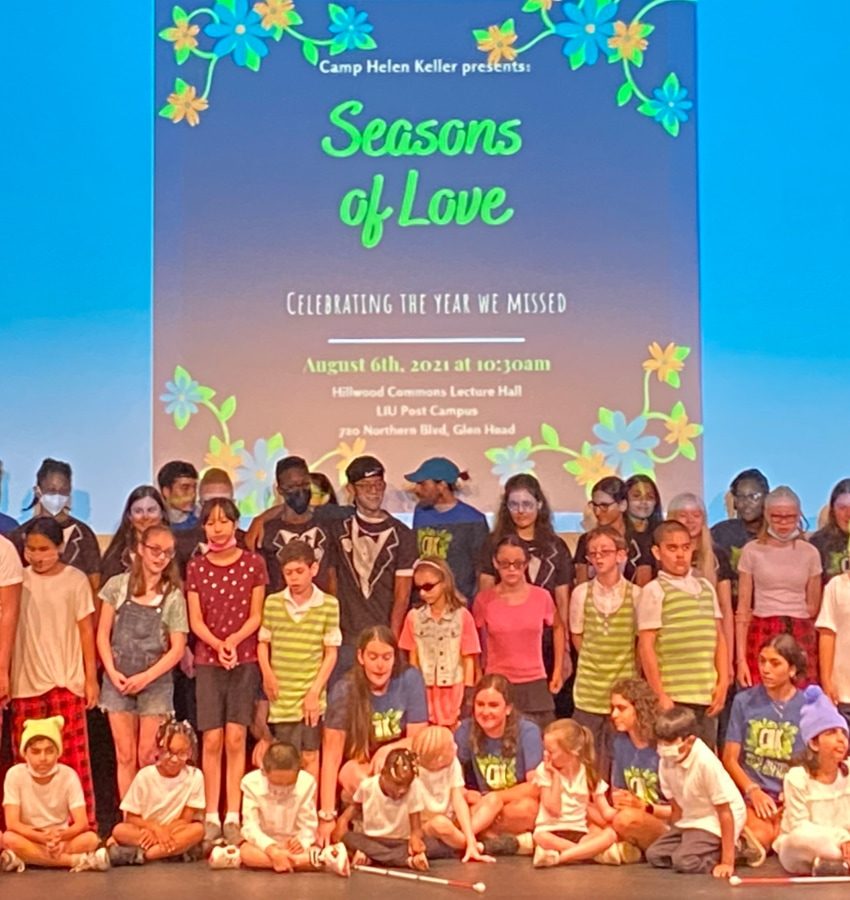

HKNC’s Summer Youth Programs (SYP) help young adults, ages 16-24, prepare for secondary education and employment. Summer Youth Vocational Program (SYVP) for DeafBlind people ages 16-22, provides on-the-job training, mobility at the work site and more. My Pursuit of Work, Empowerment & Resources (M~Power) for DeafBlind youth, ages 16-24, provides post-secondary educational counseling and workplace readiness training.

At HKS, we find solutions to meet everyone’s unique accessibility needs that are not one-size-fits-all. But their journey is only beginning and our work is far from over. That’s why we ask for your support – so everyone can live their best lives for years to come.

Here’s how your gift can help:

$50

Buys sensory toys for children in our Childrens Learning Center (CLC)

$75

Expands our career training and employer network

$100

Supports pet therapy for a child in the CLC or provides

interpreting support for the Summer Youth Programs (SYP)

$250

Supports music therapy for a child in the CLC or supports a field trip

for a group of children or young adults in the SYP

$500

Helps support a sensory gym for the children in the CLC

Every gift of any amount helps unlock potential, please give what you can!

Donate Now

Ways to Donate

Your gift to Helen Keller Services (HKS) makes it possible for us to empower people who are blind, DeafBlind, have low vision or combined hearing and vision loss to live their best lives. There are many ways you can support the life-changing work that is happening at HKS.

Choose the way to donate that resonates with you.

Outright Gifts

Donate by mail, phone or online.

Send checks made payable to Helen Keller Services:

Helen Keller Services, Development Office, 141 Middle Neck Road, Sands Point, NY 11050

Or call us at 516-833-8310

Appreciated Securities

Gifts of publicly traded stock enjoy special tax benefits. Please contact us for information.

Planned Giving

Help support Helen Keller Services today and tomorrow with Planned Giving either through:

Bequests: Leave a lasting legacy that benefits HKS by remembering us in your will.

Charitable Gift Annuities: Supplement your income with a guaranteed, fixed amount that is partially tax free. Establish a charitable gift annuity for HKS that pays you income annually. You will benefit from current and future savings on income taxes and establish a stable income for life.

Qualified Charitable Distribution (QCD): A QCD allows individuals who are age 70-1/2 or older to make deductible donations of up $100,000 total to one or more charities directly from their IRA instead of taking their required minimum distributions.

Donor-Advised Funds

Donor-Advised Funds (DAF) are one of the easiest and most tax-advantaged. When you contribute cash, securities or other assets to a DAF at a public charity fund, you are generally eligible to take an immediate tax deduction. The fund then invests them for tax-free growth. You can direct donations, from your account, to virtually any IRS-qualified public charity.

Matching Gifts

Check with your employer. Many companies will match employee contributions. Send the form with your gift and we will process the corporate match on your behalf.

Tribute

Honor. Celebrate. Remember.

Make a gift in honor or in memory of someone special by choosing any of the donation methods listed above. You can create a unique tribute to a friend, colleague or loved one, or to mark a special occasion.

Please provide us with your personalized tribute information when you donate online or by mail, and we will send an acknowledgment card to whomever you choose.

Real Property

Real property can be given as an outright gift or by bequest.

Payroll Deduction / SEFA

Employer Payroll Deduction

Many companies give employees the opportunity to direct a portion of their paychecks to the charities of their choice. Giving via payroll deduction eliminates the hassle of writing and mailing checks and enables you to spread your donations out over the course of the year, making budgeting and record-keeping easier for you. Ask your human resources representative about making gifts to HKS through payroll deduction.

State Employees Federated Appeal (SEFA)

To designate HKS as a recipient in your State Employee Federated Appeal (SEFA), please enter

65-00144 on your campaign pledge form.

Give When You Shop

Every time you shop on Amazon.com or other participating vendors’ websites you can make a donation to HKS at no cost to you.

Access Amazon.com from our page, and 0.5 percent of the proceeds from your purchase will go to HKS, helping us to help people who are blind or have low vision.

Disclosure Statement

Financial and other information about Helen Keller Services’ purpose, programs and activities can be obtained by contacting the Development Department at 180 Livingston St., 2nd Floor, Brooklyn, NY 11201, 718-522-2122 and www.helenkeller.org, or for residents of the following states, as stated below. Florida: A COPY OF THE OFFICIAL REGISTRATION AND FINANCIAL INFORMATION MAY BE OBTAINED FROM THE DIVISION OF CONSUMER SERVICES BY CALLING TOLL-FREE 1-800-HELP-FLA OR ONLINE AT www.FloridaConsumerHelp.com. REGISTRATION DOES NOT IMPLY ENDORSEMENT, APPROVAL, OR RECOMMENDATION BY THE STATE. REGISTRATION #: CH39364. MARYLAND: For the cost of postage and copying, from the Secretary of State. Michigan: MICS No. 50132. Mississippi: The official registration and financial information of Helen Keller Services may be obtained from the Mississippi Secretary of State’s office by calling 1-888-236-6167. New Jersey: INFORMATION FILED WITH THE ATTORNEY GENERAL CONCERNING THIS CHARITABLE SOLICITATION AND THE PERCENTAGE OF CONTRIBUTIONS RECEIVED BY THE CHARITY DURING THE LAST REPORTING PERIOD THAT WERE DEDICATED TO THE CHARITABLE PURPOSE MAY BE OBTAINED FROM THE ATTORNEY GENERAL OF THE STATE OF NEW JERSEY BY CALLING (973) 504-6215 AND IS AVAILABLE ON THE INTERNET AT http://www.state.nj.us/lps/ca/charfrm.htm. New York: A copy of our most recently filed financial report is available from the Charities Registry on the New York State Attorney General’s website at www.charitiesnys.com or, upon request, by contacting the New York State Attorney General, Charities Bureau, 28 Liberty Street, New York, NY 10005, or us at 180 Livingston St., 2nd Floor, Brooklyn, NY 11201. You may obtain information on charitable organizations from the New York State Office of the Attorney General at www.charitiesnys.com or (212) 416-8401. North Carolina: Financial information about this organization and a copy of its license are available from the State Solicitation Licensing Branch at 1-888-830-4989 (within North Carolina) or (919) 807-2214 (outside of North Carolina). Pennsylvania: The official registration and financial information of Helen Keller Services may be obtained from the Pennsylvania Department of State by calling toll-free, within Pennsylvania, 1-800-732-0999. Virginia: From the State Office of Consumer Affairs in the Department of Agriculture and Consumer Affairs, P.O. Box 1163, Richmond, VA 23218. Washington: From the Charities Program at 1-800-332-4483 or www.sos.wa.gov/charities. West Virginia: West Virginia residents may obtain a summary of the registration and financial documents from the Secretary of State, State Capitol, Charleston, WV 25305. CONTRIBUTIONS ARE DEDUCTIBLE FOR FEDERAL INCOME TAX PURPOSES IN ACCORDANCE WITH APPLICABLE LAW. REGISTRATION IN A STATE DOES NOT IMPLY ENDORSEMENT, APPROVAL, OR RECOMMENDATION OF HELEN KELLER SERVICES BY THE STATE.

Updated 2022